- Deep Thoughts...By Deep Ventures

- Posts

- Deep Ventures Monthly Newsletter - August 2025

Deep Ventures Monthly Newsletter - August 2025

Why we invested in Yanez, Exa Protocol's TGE, and more!

Summer’s a wrap! As temps drop and the kids head back to school, it’s time to hit reset and gear up for fall routines.

Here’s what’s new at Deep Ventures:

Why we made our latest investment in Yanez

Syndicate portfolio highlights for Exa, Demether, and Bitflow Finance

Latest industry insights - all about stablecoins and DATs

Fresh Mik and Mike episodes

Let’s go!

Why We Invested in Yanez

Back in July, we made a big bet on the Yanez MIID Bittensor Subnet - a decentralized engine for generating synthetic identity data to fight financial crime.

We broke down our thinking in an in-depth blog post: Why Yanez’s team, technology, and mission can reshape how AI apps will be built for compliance and safety.

Check it out here and hit reply to share your thoughts.

Interested in investing with us? We’ve launched our Fund 1 and we’d love for you to be involved. Please take a look at our deck, ping me at [email protected], and schedule a chat!

Syndicate Portfolio Highlights

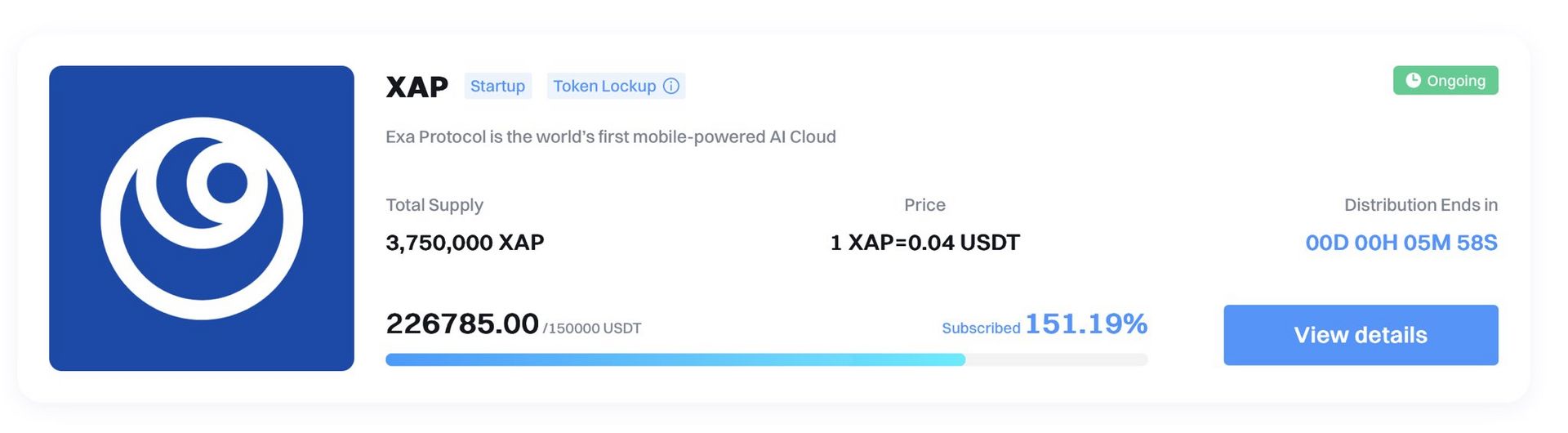

Exa Protocol executes successful IEO

Exa Protocol is the world’s first mobile-powered, decentralized AI cloud that enables users to share their mobile devices or computers for file storage and distributed computing tasks, such as AI processing.

They recently hosted a successful Initial Exchange Offering (IEO) for their native $XAP token, oversubscribing the sale in less than 24 hours! This IEO gives Deep Ventures a 5x on our investment.

The Exa team is gritty and long-term minded, having worked through the depths of the long ‘23-24 bear market to get to where they are now. Congrats to the Exa team on a successful IEO!

Demether accepted to Chainlink BUILD

Demether is an AI-driven DeFi protocol focused on unifying liquidity to enable blockchains to attract and retain liquidity at zero cost through a suite of yield-bearing, liquid restaking tokens.

They recently were accepted to Chainlink’s BUILD program and will work with the oracle provider to support the security and use of its AI-powered DeFi vaults.

They also completed the Katana / Hadron accelerator and are presenting at the Demo Day in NYC this week.

They will soon launch the MVP of their flagship product, demAI - a suite of AI-powered vaults that automate access to yield strategies.

Awesome to see all the progress that Demether is making!

Bitflow announces HODLAMM

Bitflow Finance is the leading DEX on Bitcoin L2 Stacks.

The team announced “HODLMM” (High-throughput, Orderbook-style, Decentralized Liquidity Market Maker) - the best concentrated liquidity infrastructure for Bitcoin DeFi.

Legacy automated market makers (AMMs) spread liquidity across all prices. Most of this liquidity sits unused by traders, and thus is unproductive for liquidity providers.

HODLMM lets liquidity providers concentrate liquidity where more trades are happening, just like an orderbook. The result is higher yields with less capital deployed.

This will change the game for Bitcoin DeFi.

Industry Insights

There are two prevailing themes in crypto right now - stablecoins and digital asset treasury companies (DATs).

Everyone is launching a stablecoin or a chain for stablecoin payments…

Hyperliquid plans to launch their own stablecoin, USDH, and there is a mad frenzy of proposals from companies to be their issuer of choice.

Metamask announced their stablecoin, mUSD, that will be natively integrated into their wallet.

Wyoming launched the Frontier Stable Token (FRNT) across many chains.

Stripe just announced Tempo, a new Layer-1 blockchain designed specifically for stablecoin payments, in partnership with VC firm Paradigm.

Circle also announced Arc, an L1 focused on stablecoin finance that uses their USDC as the native gas fee token.

Stablecoins are so hot right now.

…and a Digital Asset Treasury company

Following Michael Saylor and Strategy’s bitcoin acquisition model, there are DATs popping up everywhere, for all kinds of assets.

BitMine, SharpLink Gaming, ETHZilla, and other DATs continue to acquire ETH.

Trump’s Media Company just struck a deal to run a CRO (Crypto.com’s native exchange token) DAT.

Will there be a DAT for every cryptocurrency? It looks like we’re moving in that direction.

Interesting times in crypto land!

New Content and Community

Mik and Mike Crypto Cast

Check out the latest Mik and Mike Crypto Cast episodes below.

August 5 - SEC announces Project Crypto, Coinbase partners with JPM, Ethereum turns 10

August 19 - Circle and Stripe announce L1s, Story Protocol founder departs, Monero attacked

August 26 - ETH hits ATH, stablecoin announcements, Kanye launches memecoin

Let us know what you think of these episodes!

Conclusion

We hope you enjoyed this edition of the DV monthly newsletter!

Hit me up at [email protected] or @mikewchan on Telegram with your thoughts about the newsletter, what’s happening in crypto, or anything else!

Talk soon!